**UPDATE**

We received a very gracious communication from the NY Times offering to hear Russell’s vision…stay tuned…

I’m outraged that you would publish an article that associates the RushCard with other financial products, some of which prey on the underserved. The article was, in my opinion, unfair, misinformed and bordering on slanderous. The RushCard is not just a prepaid card, it’s an empowerment program that took me many years to build. It was built specifically to help people in underserved communities. It offers more than a prepaid card or a bank account.

Many of our members have low incomes and need to manage their money very closely. We offer free services like budgets, text alerts and online charts for analyzing and tracking spending. Banks don’t offer these tools. Had you spoken with our members, you would have learned that over half of those, who use these services say they save more than $300/year. That’s a lot of money for them.

Our members are left out of mainstream financial institutions and need to rebuild their credit files. You could have learned that RushCard is the only prepaid card that allows members to have their transactions reported to multiple credit reporting agencies, helping them build their credit files. We don’t charge for this either.

Our members struggle with healthcare. Not everyone can afford medicines or treatment. Had you contacted me, you would have learned that we’re bringing out a free drug discount card later this year to help our members with the high cost of prescription drugs.

We would have told you that unlike credit cards and other cards we don’t have hidden fees, overdraft fees or finance charges. We don’t hide or bury our fee structure – it’s all easily available on our website and with every card we send out. Unlike other prepaid cards, we’ve never charged for customer service. We’re more transparent than any other prepaid card. We let you transact in ways the more privileged take for granted.

We have 2 million members. These are real people who see real value in our services. Everyday I read messages from our members who are grateful for the RushCard after having terrible experiencing with their bank or financial services provider. There are thousands of stories of how people landed up with hundreds of dollars of surprise charges from their bank accounts. None of this happens on the RushCard. Had you contacted me, I would have shared these stories with you.

With today’s economic conditions, the underserved communities are being taken advantage of more than before. It’s important that they understand the good and the bad in their options. Your article focused only on the cost, which we keep as low as we possibly can, and not on the array of benefits that go beyond that of any other card, which is why it is a program, and one I’m proud to put my name on.

My empowerment initiatives, which include the Hip Hop Summit’s focus on financial education, and my many charities are there to serve people. Had you called me, you would have known all this.

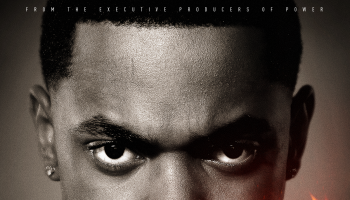

Russell Simmons